DTE 109 2009-2025 free printable template

Show details

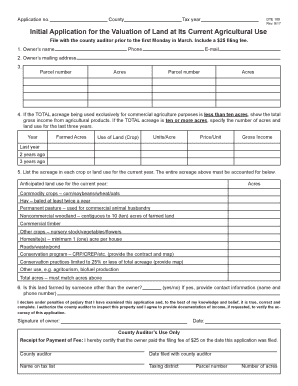

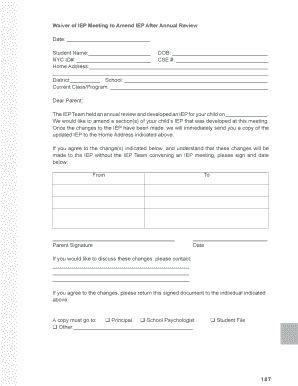

Print Form Application no. County Tax year DTE 109 Rev. 8/09 Initial Application for the Valuation of Land at Its Current Agricultural Use File with the county auditor prior to the rst Monday in March.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form dte 109

Edit your dte 109 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dte109 fillable pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DTE 109 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit DTE 109. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out DTE 109

How to fill out DTE 109

01

Gather all necessary financial information and documents.

02

Obtain the DTE 109 form from the official website or your local tax office.

03

Fill in your personal information such as name, address, and taxpayer identification number.

04

Enter your income details as required on the form.

05

Provide any applicable deductions or credits.

06

Review the filled form for accuracy.

07

Sign and date the form.

08

Submit the form to the appropriate tax authority by the designated deadline.

Who needs DTE 109?

01

Individuals or entities required to report certain financial transactions or tax-related information to the state or local tax authorities.

02

Taxpayers who have specific types of income that need to be reported in compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies for ag exemption in Texas?

What qualifies as ag exemption? To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. Agricultural purposes include crop and livestock production, beekeeping and similar activities. Many counties have minimum acreage requirements.

What is agricultural land in Florida?

"Only lands, which are used primarily for bona fide agriculture purposes, shall be classified agricultural”.

How many animals do you need for ag exemption in Texas?

Travis Central Appraisal District. How many animals do I need on my property to qualify for Agricultural Valuation? The minimum requirement for grazing stock is 4 animal units. A grazing livestock animal unit equals; 1 mature cow; 2 five-hundred pound calves; 6 sheep; 7 goats, or 1 mature horse.

What is the easiest ag exemption in Texas?

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land.

How do I become farm tax exempt in VA?

You're a farmer, grower, rancher or someone else engaged in agricultural production for market. You have a soil conservation plan in place that was approved by your local soil and water conservation district. You have a nutrient management plan developed by a certified nutrient management planner.

What is an agricultural exemption in NY?

Any assessed valuation of the eligible land in excess of its agricultural assessment is exempt from taxation. To qualify, the owner must annually submit an application verifying that the land is located within an established agricultural district and that it satisfies the property use requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send DTE 109 for eSignature?

Once you are ready to share your DTE 109, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I make changes in DTE 109?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your DTE 109 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an eSignature for the DTE 109 in Gmail?

Create your eSignature using pdfFiller and then eSign your DTE 109 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is DTE 109?

DTE 109 is a tax form used to report certain financial information to the relevant tax authority, specifically related to payments made to contractors and other service providers.

Who is required to file DTE 109?

Businesses and organizations that make payments to independent contractors, freelancers, or other service providers that meet a certain threshold are required to file DTE 109.

How to fill out DTE 109?

To fill out DTE 109, you need to provide the payee's information, including their name, address, and taxpayer identification number, along with details about the payments made during the tax year.

What is the purpose of DTE 109?

The purpose of DTE 109 is to ensure transparency in reporting payments made to non-employees and to aid tax authorities in tracking income for tax compliance.

What information must be reported on DTE 109?

The information that must be reported on DTE 109 includes the total amount paid to the payee, the nature of the payments, and the payee's identifying information.

Fill out your DTE 109 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DTE 109 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.